Traveling is more than just visiting landmarks; it’s about touching the history and culture of a nation. At Eurochange, your trusted exchange office, we believe that every banknote is a miniature masterpiece. Today, we dive into the world of the International Bank Note Society (IBNS) awards to celebrate the 2024 winner—Bermuda—and preview the stunning candidates for 2025.

The 2024 Masterpiece: Bermuda’s 5-Dollar Note

The IBNS has officially crowned the Bermuda 5-Dollar note as the “Banknote of the Year” for 2024. This stunning pink and purple polymer note has captivated judges worldwide.

The Design: It features a vertical orientation, a modern trend in high-end currency. The obverse showcases a portrait of King Charles III, surrounded by local flora and a majestic blue marlin.

The Symbolism: The reverse side highlights the natural beauty of Horseshoe Bay and the historic Somerset Bridge.

Security: Using the latest polymer technology, it includes transparent windows and intricate security patterns that are nearly impossible to forge, ensuring safety for every traveler.

| Country | Denomination | Key Features |

|---|---|---|

| Bermuda | 5 Dollars | Vertical polymer design, King Charles III, Marine wildlife. |

The 2025 Nominees: A Global Beauty Contest

The competition for 2025 is already heating up with an incredible array of designs. When you use our money online service to prepare for your next trip, you might just be holding one of these future winners:

China (20 Yuan): A festive polymer note celebrating the Year of the Snake, featuring traditional architecture.

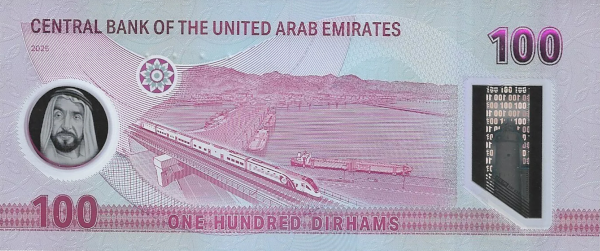

UAE (100 Dirham): Highlighting the Al Hosn Fort and the nation’s push toward sustainability and modern infrastructure.

Kazakhstan (1,000 Tenge): A mystical design featuring the Tree of Life and Saka-style art, a true collector’s item.

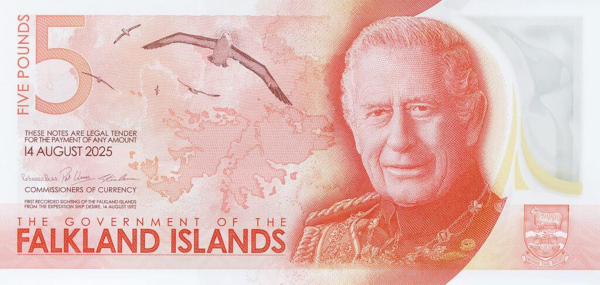

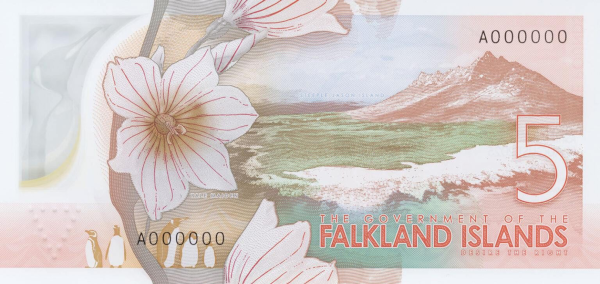

Falkland Islands (5 Pounds): A beautiful tribute to local wildlife, specifically the islands’ iconic penguin colonies.

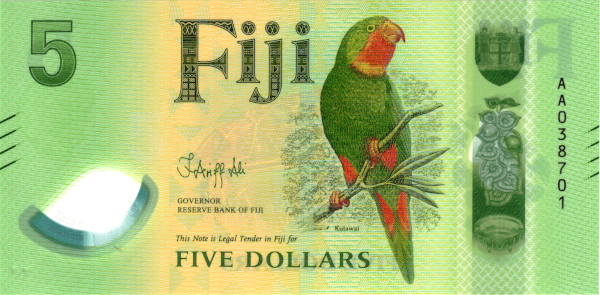

Fiji (5 Dollars): Focusing on environmental conservation with the Green Sea Turtle.

| Country | Banknote | Visual Highlight |

|---|---|---|

| China | 20 Yuan | Year of the Snake / Polymer |

| United Arab Emirates | 100 Dirham | Al Hosn Fort / Sustainability theme |

| Falkland Islands | 5 Pound | Local Penguins and wildlife |

| Kazakhstan | 1,000 Tenge | Tree of Life / Saka Heritage |

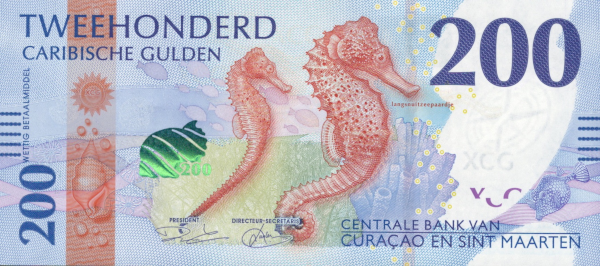

| Curacao & Sint Maarten | 200 Gulden | Marine life (Sea Horse) |

| Belice | 100 Dollar | National Heroes / Ignite Security Thread |

| Fiji | 5 Dollar | Green Sea Turtle fauna |

| Tajikistan | 100 Somoni | Ismoil Somoni architectural design |

| China (Macau) | 100 Pataka | Cultural heritage BOC edition |

| Namibia | 60 Dollar | National diamond jubilee theme |

Why It Is Essential to Carry Cash

In an increasingly digital world, money exchange for physical cash remains the traveler’s best friend:

Avoid Airport Fees: Changing money at the last minute in the destination airport often results in the worst exchange rates.

Total Budget Control: Having physical cash helps you track your spending without hidden digital “surprises.”

Safety and Acceptance: In many historical areas, local markets, or for small tips, cash is the only accepted payment. It also prevents your cards from being cloned in unsecured terminals.

Why You Should Exchange Currency Before Traveling

Choosing a specialized exchange office like Eurochange before you fly out offers unbeatable advantages:

Best Exchange Rates: We offer much more competitive rates than traditional banks or airport kiosks.

Peace of Mind: Land at your destination ready to go. No searching for ATMs or worrying about card blocks.

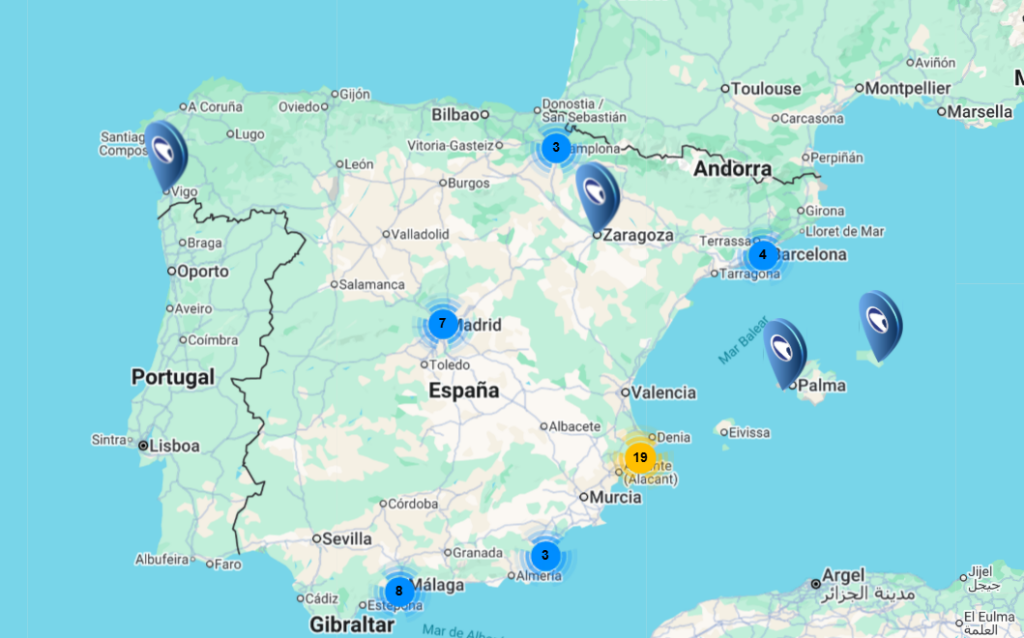

Convenience: Use our money online platform to have your currency delivered to your door or pick it up at one of our 40+ locations in Spain.

Practical Travel Tips

Early Bookings: Flights and accommodation are cheaper when booked months in advance. The same applies to your currency—reserve it early to ensure availability.

Luggage Safety: Never keep all your cash in one place. Split it between your wallet and a secure spot in your carry-on.

Local Etiquette: Research the tipping culture of your destination to ensure you have the right small denominations ready.

Every banknote tells a story. Whether it’s the award-winning pink hues of Bermuda or the intricate designs of the 2025 candidates, currency is the ultimate travel souvenir. Plan your trip responsibly, admire the art in your pocket, and always travel with the right currency.

Make this New Year count!

Make this New Year count!